One of the most common questions we get asked by car enthusiasts is how will the insurance company determine the value of my vehicle, and what will it be. Despite the seeming mystery behind this, the answer is actually pretty straight forward. It’s pretty easy to look up the value your insurance company is likely to use, or at least get close (usually within 5-10%). Of course, with high value vehicles, that kind of range could amounts to tens of thousands of dollars.

In this blog post we’ll go through the typical ways mainstream carriers get their valuations, how some of the specialty carriers get their valuations, how you can compare to it to your expectations and finally what you can do it about.

Why Valuation Matters

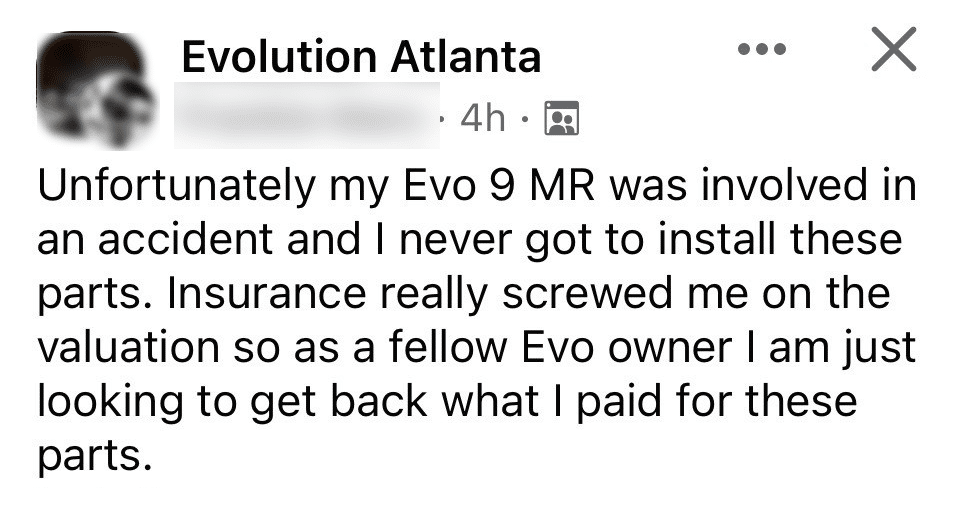

Insurance valuations matter to car enthusiasts for three significant reasons. 1) In the event of a total loss, like a significant accident or unrecovered theft, it’s the amount the insurance company will pay, 2) It’s the basis for determining whether the car is totaled in any loss scenario, 3) its used to determine the diminished value in the event of any wreck.

The challenge with valuation comes in when the amount if you have a loss that requires a total replacement, but the valuation (and therefore the payout) is less than what it takes to actual replace the vehicle, what we often call the “true replacement value”. It also could mean a vehicle you love is totaled more easily, which is less than ideal you prefer to have it repaired.

This becomes particularly important and more likely to be an issue in a number of scenarios that car enthusiasts are most likely to encounter. 1) The car is unique and hard to value, 2) the car is appreciating in value, which most mainstream carriers will admit they rarely take into account and generally assume all vehicles depreciate in value, 3) the car is restored, a project or has been modified where the typical valuation of the vehicle doesn’t take into account the replacement cost, 4) the car is imported, unique model or special edition or in some other way does not have a typical valuation available and finally 5) the traditional valuation companies are far enough behind on the changing valuation trends, particularly with modern classics, where the valuation and replacement cost is quickly changing.

Here is a spoiler, it’s a lot easier to do something about and get the valuation of your vehicle right while buying insurance, than it would be after a wreck or loss occurs. But first, let’s talk about where the value of your policy is likely to come from, some of valuation databases and what other options for determine valuation.

Where Insurance Companies Get Valuation

The vast majority of mainstream insurance companies do not have their own valuations or appraisals. In fact, about 80% of the largest insurance companies use a service called CCC Valuations. CCC is a company that uses technology to track the resale values of cars and has established a data of valuations.

CCC Valuations are generally the basis for Actual Cash Value insurance policies, and generally is also referenced in many stated value policies. If you are not familiar with these terms, you can learn more about the difference between actual cash value, stated value, agreed value and other policies types in another recent blog post we did.

If you’ve ever had a valuation dispute with an insurance company, chances are they sent you a “valuation” report, sometimes called a CCC One report. This report is an example of the information CCC collects and provides to insurance companies. For insurance companies, CCC is ideal because it’s based on real data. They can simply license it from CCC, so they don’t need to collect it themselves, and because it is documented and comes from a third party, they avoid appearing impartial if there is a further dispute about how they determined the value.

Still, despite this arms length relationship, CCC valuations may not be sufficient in the scenarios we outlined above. You often can request the valuation for your vehicle from your insurance company, or in the case you are dealing with someone else’s insurance company, from them.

Hagerty Valuation

Hagerty has done such a good job creating enthusiast value database for their insurance needs, a number of mainstream companies use Hagerty’s tool when offering enthusiast or collector coverage. Progressive and State Farm both use Hagerty’s database for their collector offerings. The Hagerty database is generally far closer to the actual enthusiast market than CCC valuations.

However, even Hagerty’s tool is only effective with more popular enthusiast and collector cars. If you have modifications, a unique vehicle, an imported vehicle or other specialty car you may still find Hagerty does not have an entry for it, or the value may not be reflective of the replacement cost.

We should also note that your insurance company is not obligated to use Hagerty’s valuation, and in most cases unless it’s a specific collector or enthusiast offering policy, they don’t .

Independent Appraisers

In the event you need a car appraisal, there are a number of industry associations with auto appraisers to help you find one. Independent auto appraisers, just like the appraisers for your home, take your unique vehicle and situation and find comparable sales and appraisals to help determine an accurate value.

Appraisals can be useful if you need additional documentation on the value of your vehicle or if you don’t have an agreed value policy and must establish value after the fact. Still, it is important to note that just because you get an appraisal that is different than the CCC or other valuation your insurance company used, doesn’t necessarily mean you’ll get that amount.

Finding An Appraiser

In most cases you’ll need a certified appraiser. Here are a few organizations to help you find appraisers if you ever need one. They generally require all of their appraisers to be certified. We would not recommend using an appraiser who is not certified.

Complete Georgia Car Appraisal Resources

Click here to see our complete blog post with car appraisal resources.

Appraiser Directory Quick Links

The American Society of Certified Auto Appraisers

International Automotive Appraisers Association

Independent Auto Damage Appraisers Association

Bureau of Certified Auto Appraisers/IACP Certified

Some Additional Valuation Tools And Databases

Kelly Blue Book

Interesting enough the most famous valuation tool is likely Kelly Blue Book (KBB). While a number of years ago this was actually a blue book that car dealerships and insurance companies can use, most of this information is no online. While KBB is more popular in the dealership business, they are owned by Cox and license their data to a number of different companies.

NADA (National Automobile Dealers Association)

Another popular database of values is from NADA. NADA stands for the National Automobile Dealers Association. NADA has been cataloging used car values for decades. Their primary goal with their valuation is to provide information to dealers about the value of used cars – what they should expect to pay for trader ins and what they can hope to get at retail.

While NADA database is not specifically insurance related, it can provide a third party source of potential value.

In our experience, don’t expect a massively different valuation between NADA, KBB and CCC, though they can be worth comparing.

What Happens When You Can’t Agree To A Value With Your Insurance Company

All of these valuation tools and information are really building to the main question people want to know. If you’ve had a wreck or loss – if you and your, or the other parties, insurance don’t agree, what can you do about it?

You can attempt to document publicly available information from Hagerty, KBB and other sources. Your claims rep likely has some room so if the difference isn’t huge it may be sufficient for them to get a different value approved. However, if you are significantly off don’t expect that to be sufficient.

You can file for an appraisal review and/or appraisal arbitration. What will be required is you and the insurance company will each have to hire an appraiser. You will have to pay out of pocket for your appraiser. Each of your appraisers will pick a third appraiser, which is usually split by both parties. If any two appraisals are the same or near each other, that value is used. If none of them are near each other, the third appraisal is used. When you go down this path there is generally no additional recourse. So if the value isn’t what you want, you are stuck with their decision.

You can sue. If you are dealing with your own insurance company, by nature of your policy you are likely going to have to go to arbitration, which may result in a process similar to what we describe above using appraisers to determine the valuation. However, it may involve a judge, acting as a arbitrator, who makes the determination or orders appraisals. This process is significantly more expensive, and depending on your policy may not even be advantageous, because you may not wind up with any more influence over the process than you would just using appraisers.

We recommend saving this route for the most extreme situations.

File a complaint with the insurance bureau. Your state insurance bureau, specifically here in Georgia, requires insurance companies fix your vehicle or provides reasonable replacement value by law. However, given the standardization in the industry, unless you can show the insurance company is acting in bad faith, this approach is unlikely to get you a substantially different payout than you would through appraisal.

How To Avoid Valuation Issues In The First Place

The best bet with valuation questions is to avoid them in the first place. There are a few ways to can help head off valuation issues early in the insurance process. You also have a lot more leverage during the buying process than you do after a loss. While you may not necessarily be able to get the insurance company to change it’s valuation, you can choose a different type of policy or even switch to an insurance company where the valuation is closer to your expectations of replacement value.

Know The Valuation Up Front

You can always lookup what the valuation of your vehicle is using the tools describe above. Your existing, or the new insurance company, may even offer to send you the CCC, or similar, report. This would allow you to clearly see what they would use as the value of your vehicle. Additionally, if the company you use or are considering buying from uses Hagerty’s database and find that valuation inline with your expectations, you can simply confirm the valuation with them. If your insurance company is near your expected valuation, you are less likely to have an issue. Though it’s important to note that the valuation can change over time and it still may not be a guarantee you’ll get what you want.

Coverage For Modification, Restorations, Swaps and Other Investments

Other than the typical valuation being slightly low or behind the actual market for vehicles, one of the most common reasons for a valuation difference with insurance companies is the investment made into the vehicle like modifications, doing a restoration, or engine swap. For the average driver, this may not be a common scenario. But for car enthusiasts, these scenarios are very common. In our experience it’s the most common cause of valuation disagreements with insurance companies.

It’s not uncommon to invest tens of thousands of dollars into your car to improve it, make it unique or otherwise make it yours. Even collector databases like Hagerty have no way to account for this in valuation. In fact, in these scenarios valuation isn’t really even the right question – the right question becomes “what is the true replacement cost” for this vehicle.

Regular insurance policies do not cover these modifications, in fact in most cases they are outright excluded. While your insurance company may make minor accommodations, if you attempt to dispute the value of the vehicle based on these conditions, your insurance company may use their leverage to deny it. Even if the wreck isn’t your fault, your insurance company likely may be limited in what they fight for on your behalf with the at fault company. In that situation you really need to specifically disclose and pay for coverage that includes these types of investments.

Agreed Value Policy

What Are Agreed Value Policies?

Unlike Actual Cash Value policies, where the value is determined by the insurance company at the time of the loss, agreed value policies allow you and the insurance company to determine a value up front. Insurance companies may also offer Agreed Value policies where the valuation is stated and not based on the CCC or third party evaluation tool.

Though we do recommend being careful when using “stated” policies. If the policy is branded a Stated (marketing term), be sure it’s still an Agreed Value policy. Some insurance companies let you “state” a value, but they are still cash value policies and they are not bound to use that as the valuation. Agreed Value policies differ because unless there is a reason to believe the information has changed or considered fraudulent, your insurance company will be obligated to use the value agreed to.

What Happens If You Are Not At Fault

Another way Agreed Value policies matter is if you are not at fault. Because you don’t have an agreement with the at fault insurance company, they are not obligated to use that valuation. However, in this instance your insurance company is obligated to make up the difference. This can substantially reduce the headache and effort on your part. They will do this with a right called Subrogation. While you have to reasonably comply to help them, the insurance company generally does the vast majority of the work.

What Can Be Covered With Agreed Value Policies And How Does That Impact Valuation?

Agreed Value policies often can include modifications, swaps, restorations and other investments that may not necessarily reflect in a regular valuation. They are specifically designed to do it. And because the risk and the value is factored into the quote, for insurance companies they don’t consider this extra risk. Interestingly enough while it seems like agreed value policies would always be more expensive than traditional policies, we’ve actually seen the opposite a lot.

In most instances you do not need an appraisal ahead of time for an agreed value policy. While there is a certain point value point or unique cases where the insurance company may require an appraisal up front, for most enthusiast vehicles, it is not often required. Do expect to provide a list of modifications and investments (high level) and/or pictures in most instances.

Another thing to consider is that you don’t need to have $100,000 collector car for Agreed Value to be worth it. Modern classics, project cars, modified cars and even dedicated track or race cars all make sense. Anything where the replacement value isn’t the same as the insurance valuation it’s at least worth considering. In fact many enthusiast specialty insurers offer Agreed Value policies at values starting at $5,000. Finally, most companies now have policy offerings that allow you to drive them, some even regular mileage. In the past this was a common complaint with enthusiast insurance, but that is rapidly changing.

Shift Brokers Can Help You Navigate

Shift Brokers is car insurance for car enthusiasts. We can help you understand the how different carriers will value your specialty car. In addition, we can help you select from insurance companies that will get you the kind of service and coverage you need. And because we are car enthusiasts and specialize in policies for car enthusiasts, we can help you navigate the unique needs and situations only car enthusiasts find themselves in. The best part is, because we are brokers, we represent you, not the insurance companies. There is never any obligation to work with us.

Contact Me About My Insurance Needs Or Questions

Informational Purposes Only

As with all of our blog posts with tips and suggestions about car insurance for enthusiasts, these are intended as general information. The specifics of your policy and carrier may differ. The information in this blog post is not intended to be formal insurance advice. However, if you’d like to talk to a licensed agent about your specific needs or questions, get a quote. Always read your existing and any new policies carefully.